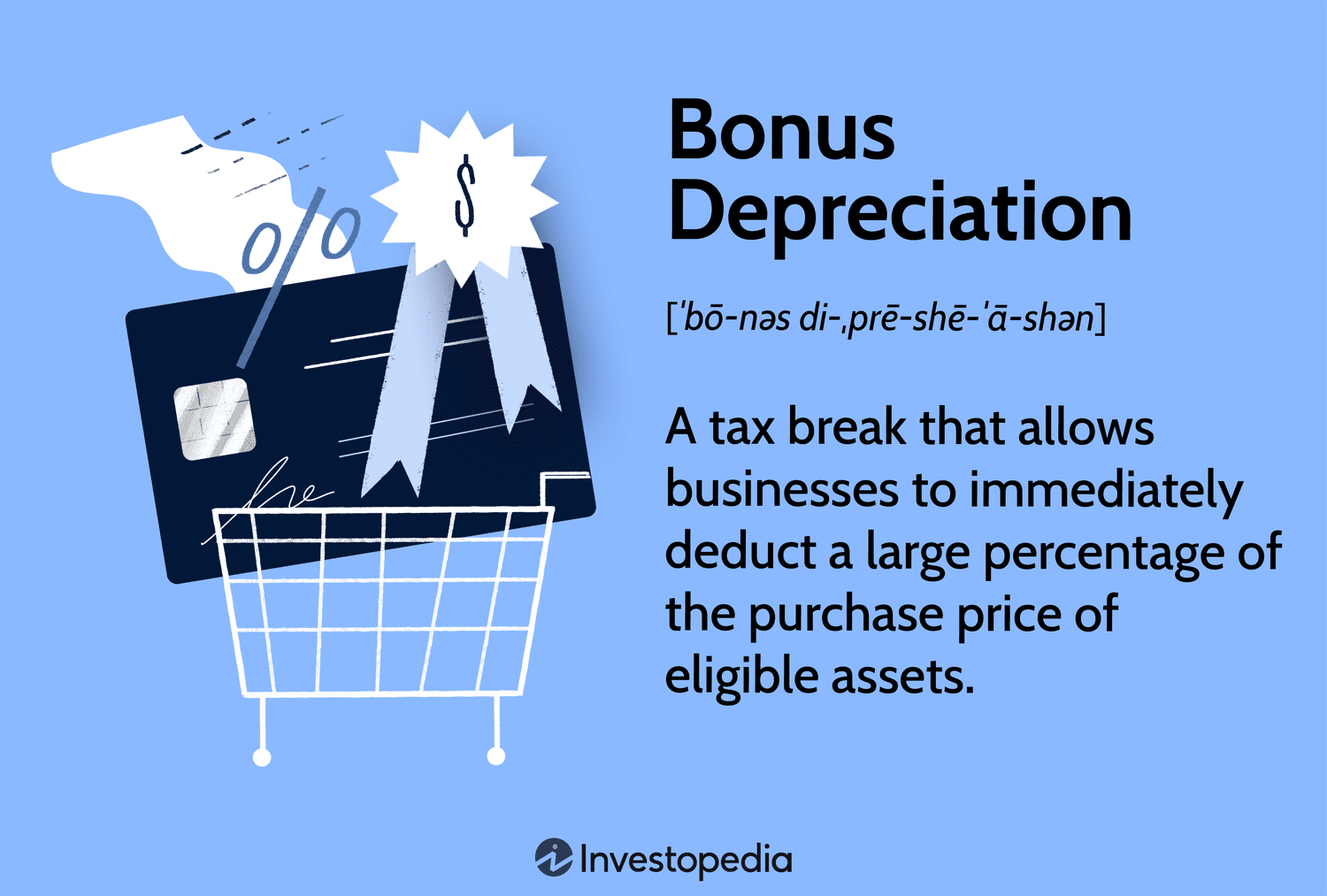

The advancement of the Tax Relief for American Families and Workers Act signals a significant development for commercial real estate (CRE) investors. Central to this legislation is the proposal to reinstate 100% bonus depreciation, a provision that has the potential to reshape investment strategies within the CRE sector.

Under the Tax Cuts and Jobs Act of 2017, businesses and investors were allowed to write off 100% of the value of assets with a lifespan of less than 20 years. This provision was aimed at stimulating investment and fostering economic growth. However, it was structured to gradually phase out, with the write-off percentage set to decrease to 80% by 2023 and eventually sunset by 2027.

The reintroduction of 100% bonus depreciation under the proposed legislation presents a compelling opportunity for CRE investors. By allowing for immediate write-offs of eligible assets, investors can enhance cash flow, reduce tax liabilities, and accelerate returns on investment. Moreover, this provision can incentivize capital investment and spur growth within the CRE sector, driving economic activity and job creation.

For investors, understanding the potential impact of this legislation is crucial. By staying informed and proactive, investors can position themselves to capitalize on the opportunities presented by 100% bonus depreciation. From optimizing investment structures to identifying eligible assets for immediate write-off, proactive planning can help investors maximize the benefits of this tax provision.

As the Tax Relief for American Families and Workers Act progresses through the legislative process, investors should monitor developments closely and assess the implications for their investment strategies. By staying abreast of changes in tax policy and adapting their strategies accordingly, investors can navigate the evolving landscape of CRE investments with confidence and success.

To learn more about the potential impact of 100% bonus depreciation on CRE investments, click the link below.