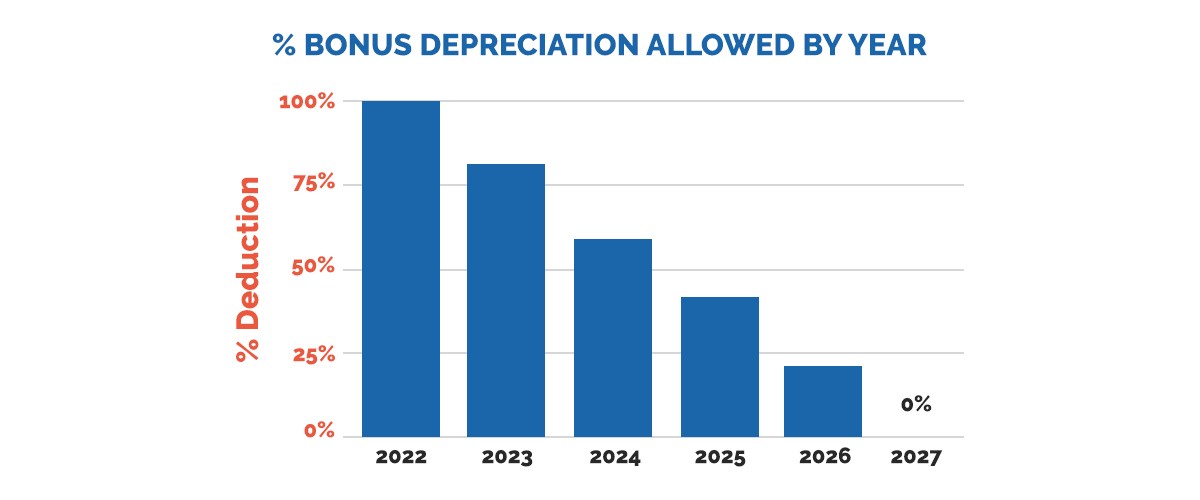

The proposed reinstatement of 100% bonus depreciation under the Tax Relief for American Families and Workers Act holds immense potential for multi-family real estate investors. This provision, if enacted, could offer significant tax advantages and enhance investment returns within the multi-family sector.

Historically, bonus depreciation has been a valuable tool for real estate investors, allowing for accelerated depreciation of eligible assets and thereby reducing taxable income. In the context of multi-family investments, this provision can be particularly advantageous, enabling investors to offset income and maximize cash flow.

One key strategy for leveraging 100% bonus depreciation in multi-family investments is through cost segregation studies. By identifying assets within properties with a lifespan of less than 20 years, investors can allocate costs to these assets and accelerate depreciation deductions. This can result in substantial tax savings and improved cash flow, allowing investors to reinvest capital and enhance overall returns.

Additionally, the proposed legislation includes provisions to increase the child tax credit, providing further benefits for tenants with families. This can improve rental demand and occupancy rates within multi-family properties, bolstering investor confidence and driving property values higher.

As investors assess the potential impact of the Tax Relief for American Families and Workers Act on multi-family investments, proactive planning and strategic execution will be essential. By leveraging 100% bonus depreciation and capitalizing on favorable market conditions, investors can position themselves to maximize returns and achieve long-term success in the dynamic multi-family real estate market.

To learn more about how to maximize returns through leveraging 100% bonus depreciation in multi-family investments, click the link below.