In recent years, Environmental, Social, and Governance (ESG) investing has surged in popularity, reflecting a growing awareness of the importance of sustainability and ethical considerations in investment decisions. Let’s delve into the rise of ESG investing and how it enables investors to align their values with their financial goals.

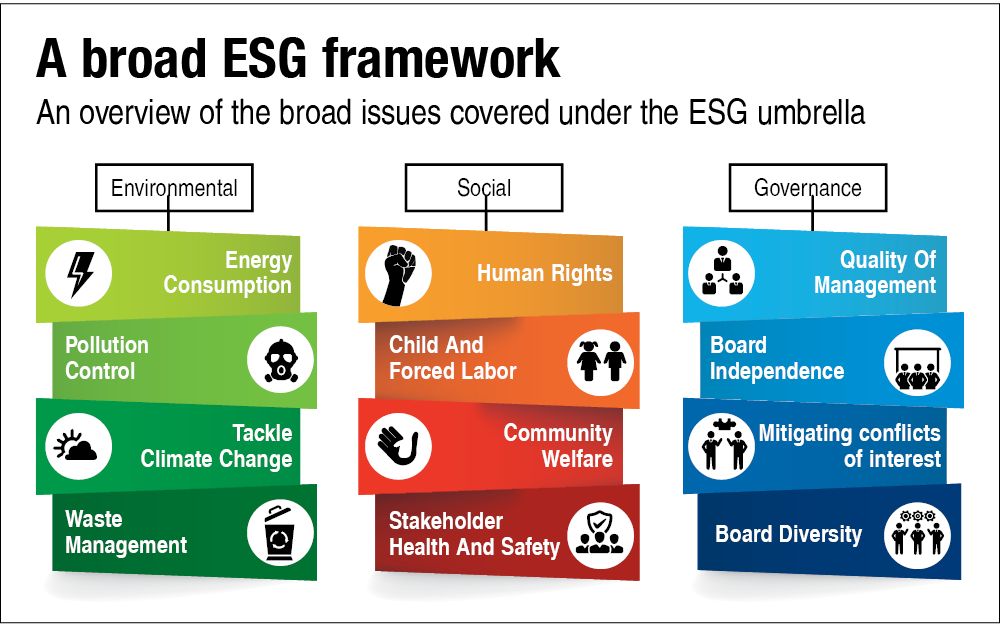

ESG investing integrates environmental, social, and governance factors into the investment process, allowing investors to support companies that prioritize sustainability, social responsibility, and ethical practices. By considering these factors alongside traditional financial metrics, investors can potentially enhance their returns while making a positive impact on society and the environment.

One of the key attractions of ESG investing is its potential to generate competitive returns while also promoting positive change. Studies have shown that companies with strong ESG credentials tend to exhibit better long-term performance and resilience, suggesting that sustainable practices can contribute to financial success.

Moreover, ESG investing allows investors to express their values and preferences through their investment decisions. Whether it’s supporting renewable energy initiatives, promoting gender diversity in corporate leadership, or advocating for human rights, ESG investors have the opportunity to drive positive change in areas that matter to them.

If you’re interested in incorporating ESG considerations into your investment strategy or want to learn more about specific ESG opportunities, our team is here to help. We can provide insights into ESG trends, identify suitable investment options aligned with your values, and help you integrate ESG principles into your portfolio effectively.

To learn more about the rise of ESG investing and how it can benefit your investment approach, click this link. Our experienced advisors are dedicated to helping you align your financial goals with your values and make a positive impact through your investments.